Target Stock: Target Corporation (NYSE: TGT) is an American retail corporation with a long history that became one of the largest retail chains in the country. It was founded in 1902, and since then, it has developed a wide range of goods provided by the company, including apparel, home goods, electronics, and groceries. Being headquartered in Minneapolis, Minnesota, the company has a large number of its stores across the country.

It may be assumed that one of the first steps in understanding the potential of a stock is learning more details about a company, to which it belongs. The history, its leaders, amount of sales, and other concerning facts will be taken into account while making investment decisions.

May you like this

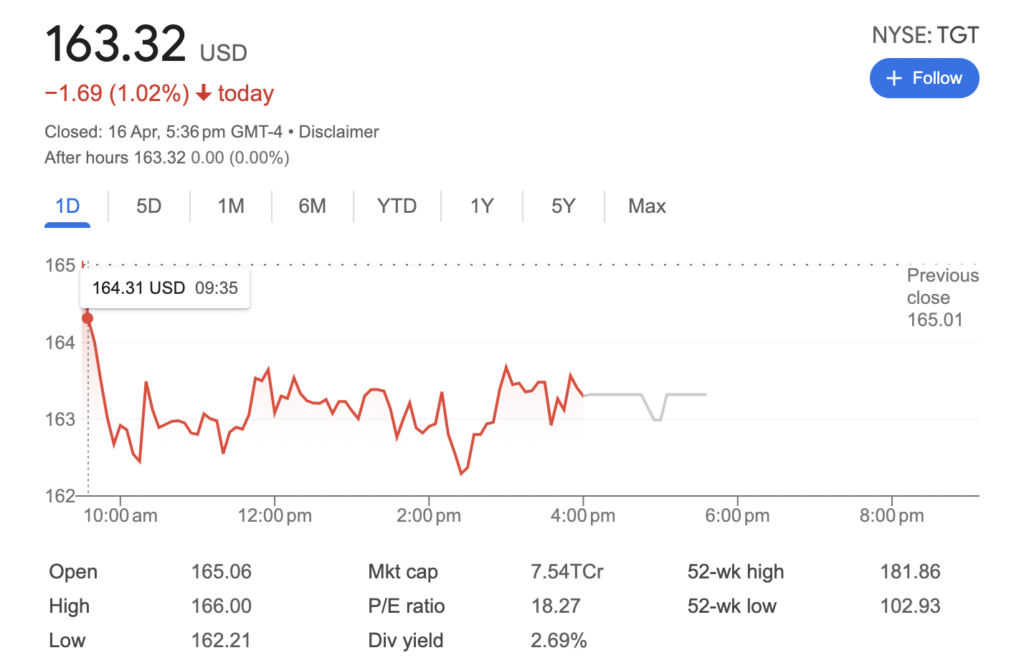

Target Stock Price Today

163.32 -1.69 (1.02%)

After hours: 163.32 +0.00 (0.00%)

TGT(NYSE)

Investing in shares of Target allows people to own a part of this legendary retail company. The shares have a varied price depending on different factors, such as the overall state of the market, consumer trends, competition in the industry, and the corporation’s business reports. As per the most recent data, the Target stock price is rather steady. This is a testament to the company’s success and ability to adapt to market pressures.

Investors monitor the corporation’s business reports, financial results, and new strategies to obtain information about the firm’s positions and decide whether they want to invest. Target has come up with new innovations and customer-friendly strategies, such as investments in e-commerce venues, the renovation of its department stores and their design, and state-of-the-art shopping technologies and equipment.

Some other highlights are Target’s rationale for new brand deals, investments, and a range of improvements to the shopping experience. All of these options and advantages help the retailer’s stock to reduce the risk and stay secure as the best retail investment.

Internal factors contributing to a Target stock drop

Poor financial performance

- If Target’s earning results are lower than expected, the company issues reports of less profitable revenue or less ambitious growth estimates. As a result, the stock will likely plunge as a reaction to the disappointing news. It is also reasonable to assume that investors’ uncertainty about the future rise of the stock will likely lead to a reduction in its price.

Management issues

- Executive upgrading, leadership changes, and other issues of corporate management can also contribute to a decrease in the stock’s value as the changes can raise uncertainty and reduce investor confidence, thereby decreasing the value of shares of stock in the company.

Product recalls or concerns

- Negative broadcasting of Target’s issues with product recalls, controversies over the safety of Target’s operations, or waste issues will result in a decline in consumer confidence and stock value.

Strategic fails

- Poorly received one-off business events, such as poorly timed and unpopular fee hikes or failed expansion plans, can also push stock investors to reconsider the future of their investments, potentially abandoning their shares and reducing the value of the stock as a result.

External factors

- The downturns in the national economy

- Worse and decrease int he national economy will ultimately contribute to a decline in the stock of a retail company such as Target as its sales will decrease in unison with the decreasing purchasing power of the population.

Industry issues

- The development of aggressive competition or other issues affecting the profitability of all retail venues will also push stock prices down.

Market viability

- Geopolitical developments spread market panic and lower the value of companies’ stocks across multiple industries.

Why is Target Stock falling

The decrease in Target’s stock price has been developing for some time due to several reasons. The demand for non-essential goods is weaker than expected to due such reasons as inflation and interest rate issues. This area of business goods for non–essential areas is quite prevalent in Target’s product line. At the same time, there were theft issues, and some stores had to be closed. The latest earnings show some improvement in profit margin indicators, but sales are still sluggish, and the company predicts slow and steady growth in 2024.

Target Boycott Stock

Boycotting Target may or may not influence the price of TGT, but it depends upon various factors. Here is how a TGT boycott would affect a company’s stock:

- Impact on the Prospective Customers: If a boycott is observed, say, on some controversial business lines adopted by the company or some strategies introduced by TGT, and a considerable part of TGT’s customers also participate in the same. It will affect the sales and, thereby, TGT’s stock price. Bohret also explains that while investors were not big supporters of the new initiatives first, they are also subjected to the influences of the views of the prospective customers or the market in general.

- Customers of TGT: sayings and arguments will be reflected in the price of TGT. This is because if a substantial number of people urge the public to stop shopping at TGT, and the general public feels either positive or interested in these arguments or – too bad-hysterical, and future sales of TGT products will, therefore, decline. In view of this, the price of TGT will also drop, making his explanations to his investors received very critically.

- Many people make decisions based on price fluctuations and changes in price. This could mean a decrease in future sales for TGT as many people will then shun their stores. As a result, the price of the company’s stock may go down, and the explanations that the management gives to their investors might be taken as just excuses. However, if the number of people participating in the boycott is minimal, there will be no significant impact on TGT’s stock price.

Target Stock Chart

Target Stock Earnings

Target’s financial performance would take a hit from a decline in sales and revenue due to a boycott of its products. Accordingly, those figures would be readily observable in their earnings reports and, as such, in the upshots for their appreciative stock prices. For instance, their stock prices would take a hit if the data on Target’s revenue growth, profit margins, and earnings per share were lower after the boycott than they were before it. Long-term reputation: How the boycott is handled by the corporation also impacts stock prices.

A boycott’s result would be of a smaller magnitude if the company empathized and instituted controls over any unethical practices that had been the reason for the boycott in the first place. Further, the impact would be diminished if the corporation takes preemptive actions against boycotters’ concerns and puts their affairs in order on their own. A target would see its stock prices take a hit in the cases where its counterparts are not met. Target Stock Earnings Quarterly reports. These reports are updated on a quarterly, i.e. three month, three-month basis. Accordingly, these reports contain the detailed outcomes from the past quarter’s operations of the company.

Key Metrics

- Their earnings per share – the measure of the target’s profitability on a per share basis

- The total revenues of goods and services recorded during the quarter in question

Their comparable sales growth represents the difference between quarterly sales volumes and those that exclude new store openings of stores. Analysts’ expectations for Target’s results are frequently accompanied by analysts in the financial sections in the United States. These analysts frequently highlight their estimates of the target’s earnings and revenues directly before they’ve released the final results. The resulting final results frequently indicate the extent to which a target’s financial performance is similar to or different from those estimates. Conference calls. After Target updates their financial reports, it frequently follows the same up with an earnings conference call. In these phone conferences, the management of the corporation reviews its financial results over the past quarter, key performance indicators, and goals for the future.

- “Of course, a profit warning is bad news for a company and will certainly affect the share price but it is not the end of the world.”

- Guidance: In addition to the earnings release, Target may also provide guidance for the upcoming quarters or fiscal year. This guidance may include the company’s forecasts for revenue, earnings, and other metrics that can provide some information to investors about Target’s future performance. If the company’s performance is lower than analysts’ expectations for revenue or earnings, then its stock price is likely to fall.

- Market reaction: In the days following Target’s announcement of earnings release and conference call, the price of its shares will either rise or fall substantially, depending on the magnitude of the difference between Target’s performance and the company’s guidance or analysts’ expectations. A surprise that is in excess, better performance relative to the company’s guidance or consensus analyst estimates, is considered a positive earnings surprise. Such a development will raise Target’s stock price. On the other hand, a positive surprise is a negative indication for the stock.

Therefore, it is important to note that while a boycott is capable of affecting Target’s stock in the short term, investors will be concerned with the business’s financial position, its competitive performance and longer-term growth. Thus, while the boycott may result in a temporary decline in the company’s stock, the long-run effect will be determined by how Target manages the crisis and takes care of the concerns of the interested party.

FAQs

Q1: What is the ticker symbol for Target and on which exchange does it trade?

Ans: Its ticker symbol is TGT, and it trades on the New York Stock Exchange.

Q2: How has the stock been performing recently?

Ans: The stock has been under pressure and has dropped nearly 30-40 percent over the past 6-12 months, largely due to weak same-store sales and broader headwinds in the retail space.

Q3: Did Target meet their earnings expectations?

Ans: Yes for Q2 2025, with the EPS coming in at $2.05, which was above the consensus number of $2.04. Revenue dropped almost 0.9%.

Q4: What is Target’s biggest risk factors and headwinds at the moment?

Ans: Some of the bigger headwinds are weak consumer spending, inflation and cost, tariffs/supply chain costs and then competitive pressures from discount stores.

Q5: Is the stock cheap, or undervalued right now?

Ans: Some analysts think it has value, in relation to earnings and dividend yield. Other analysts think it could be a “value trap” if sales trends are not improving.