Target Stock – Target Corporation (NYSE: TGT) is a renowned American retail corporation known for its diverse range of merchandise, including apparel, home goods, electronics, and groceries. Founded in 1902 and headquartered in Minneapolis, Minnesota, Target has grown into one of the largest retail chains in the United States, with numerous stores across the country.

May you like this

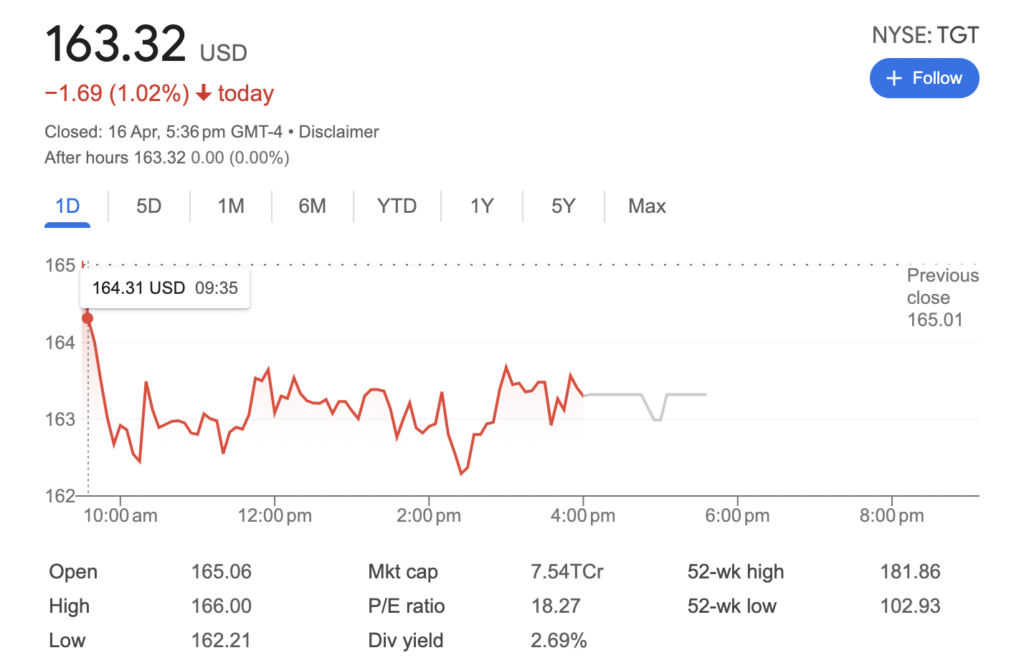

Target Stock Price Today

TGT(NYSE)

Investing in Target stock provides individuals with an opportunity to own a piece of this iconic retail brand. Target’s stock price is subject to fluctuations influenced by various factors, including overall market conditions, consumer spending trends, competition within the retail sector, and the company’s financial performance.

As of the most recent data, Target’s stock price has been performing steadily, reflecting the company’s resilience and adaptability in the face of changing market dynamics. Investors often track Target’s financial reports, quarterly earnings, and strategic initiatives to gauge the company’s growth potential and assess the attractiveness of its stock.

Target has demonstrated a commitment to innovation and customer-centric strategies, including investments in e-commerce, store remodels, and exclusive brand partnerships. These efforts have contributed to Target’s ability to stay competitive in the retail landscape and maintain investor confidence in its long-term prospects.

When does Target Restock

Target doesn’t publicly reveal exact restocking times for in-store or online inventory. However, stores likely receive shipments on weekdays, with Mondays, Wednesdays, and Fridays being common possibilities. Some reports suggest clothing gets restocked daily, with new arrivals on Mondays and Thursdays. Home goods restocking might happen every other Wednesday.

Ultimately, restocking varies by store and depends on their inventory needs. While you might not be able to pinpoint an exact restocking time, checking the store early in the week, especially after the days mentioned above, might increase your chances of finding what you need.

Target Stock Drop [Target Stock Loss]

A Target corporation Stock price drop refers to a decrease in the value of Target Corporation’s shares in the stock market. This decline can occur for various reasons and may be influenced by both internal and external factors.

Internal factors that could contribute to a Target stock drop include:

- Poor financial performance: If Target reports lower-than-expected earnings, revenue, or growth forecasts, investors may react negatively, causing the stock price to drop.

- Management issues: Executive turnover, leadership changes, or corporate governance concerns can erode investor confidence and lead to a decline in the stock price.

- Product recalls or controversies: Negative publicity surrounding product recalls, safety issues, or controversies related to Target’s operations can impact consumer trust and investor sentiment, resulting in a stock drop.

- Strategic missteps: Poorly received business decisions, such as failed expansion efforts or ineffective cost-cutting measures, may cause investors to reassess the company’s prospects and sell off shares, driving down the stock price.

External factors that could contribute to a Target stock drop include:

- Economic downturns: During economic recessions or periods of economic uncertainty, consumer spending may decrease, impacting Target’s sales and profitability, and leading to a decline in the stock price.

- Industry competition: Intense competition from online retailers, discount stores, or other brick-and-mortar chains can pressure Target’s market share and margins, potentially resulting in a stock drop.

- Market sentiment: Changes in investor sentiment, market volatility, or macroeconomic factors can influence stock prices across industries, including retail, causing Target’s stock to decline even if the company’s fundamentals remain strong.

- Global events: Geopolitical tensions, natural disasters, or public health crises can disrupt supply chains, consumer behavior, and overall market sentiment, leading to a decline in Target’s stock price.

Why is Target Stock falling

Target’s stock price has been down for a while due to a combination of factors. There’s been weaker demand for non-essential items like clothing and home decor, which are a big part of their business, as inflation and interest rates put a strain on consumer spending. Additionally, Target has faced challenges with theft, leading to store closures and impacting profitability. While their recent earnings report showed improved profit margins, sales are still sluggish, and the company predicts slow growth for 2024.

Target stock represents an investment opportunity for those interested in the retail sector, offering the potential for capital appreciation and dividends. However, like all investments, it carries inherent risks, and individuals should conduct thorough research and consider their financial goals and risk tolerance before investing in Target or any other stock.

Target Boycott Stock

A Target boycott can potentially impact the company’s stock price, although the extent of the effect depends on various factors, including the scale and duration of the boycott, as well as how the company responds to the situation.

Here’s how a Target boycott could affect its stock:

- Public Perception: If a significant portion of Target’s customer base decides to boycott the company due to a particular issue, such as a controversial business decision, policy, or event, it could lead to negative publicity and damage the company’s reputation. This negative sentiment might cause investors to become wary and could contribute to a decline in Target’s stock price.

- Sales Impact: A boycott could potentially impact Target’s sales, particularly if it leads to a decrease in foot traffic to its stores or a decline in online purchases. If sales figures suffer as a result of the boycott, investors may react by selling off Target’s stock, anticipating weaker financial performance.

- Financial Performance: A decline in sales and revenue due to a boycott could impact Target’s financial performance, affecting its earnings reports and future growth prospects. Investors closely monitor financial metrics such as revenue growth, profit margins, and earnings per share (EPS), and any negative impact from a boycott could lead to downward pressure on the stock price.

- Long-term Reputation: How Target responds to a boycott can also influence investor sentiment. If the company takes proactive steps to address the concerns of boycotters and demonstrates a commitment to corporate responsibility and ethical business practices, it may help mitigate the negative effects on its stock price. Conversely, a poorly managed response could exacerbate the situation and prolong the impact on the company’s reputation and stock price.

Target Stock Chart

Target Stock Earnings

Quarterly Reports:

- Target Corporation releases earnings reports on a quarterly basis.

- These reports provide detailed information about the company’s financial performance during the previous quarter.

Key Metrics:

- Earnings per Share (EPS): Target’s EPS is a crucial metric that indicates the profitability of the company on a per-share basis.

- Revenue: The total revenue generated by Target from sales of goods and services during the quarter.

- Comparable Sales Growth: Target often reports its comparable sales growth, which compares sales from stores open for at least one year, providing insights into the company’s performance excluding the impact of new store openings.

Analyst Expectations:

- Analysts provide estimates for Target’s earnings and revenue before the earnings report is released.

- Target’s actual earnings are compared with these estimates, influencing investor sentiment and stock price movements.

Conference Calls:

- Target typically holds earnings conference calls shortly after releasing its quarterly earnings report.

- During these calls, company executives discuss financial results, key performance indicators, and provide insights into future strategies and initiatives.

Guidance:

- Target may also provide guidance for future quarters or the fiscal year ahead during its earnings release.

- This guidance includes forecasts for revenue, earnings, and other financial metrics, which can impact investor expectations and stock price movement.

Market Reaction:

- Following the earnings release and conference call, Target’s stock price may experience significant movement based on how the company’s actual performance compares to analyst expectations and its own guidance.

- Positive earnings surprises often lead to stock price increases, while negative surprises can result in stock price declines.

Overall, while a boycott can potentially have a short-term impact on Target’s stock price, investors also consider the company’s overall financial health, competitive position, and long-term growth prospects when evaluating its stock. Depending on the circumstances, a boycott may lead to temporary fluctuations in the stock price, but its long-term effects will depend on how Target manages the situation and addresses the underlying concerns of its stakeholders.